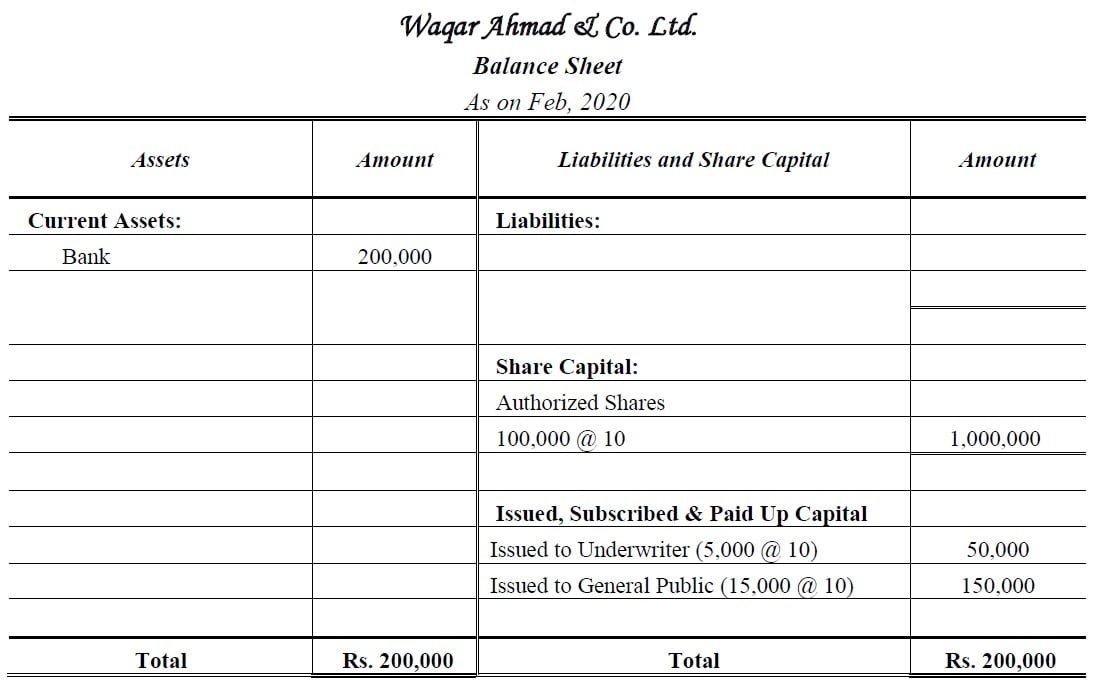

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Thereś a company with 1000 Authorised share capital 1share.

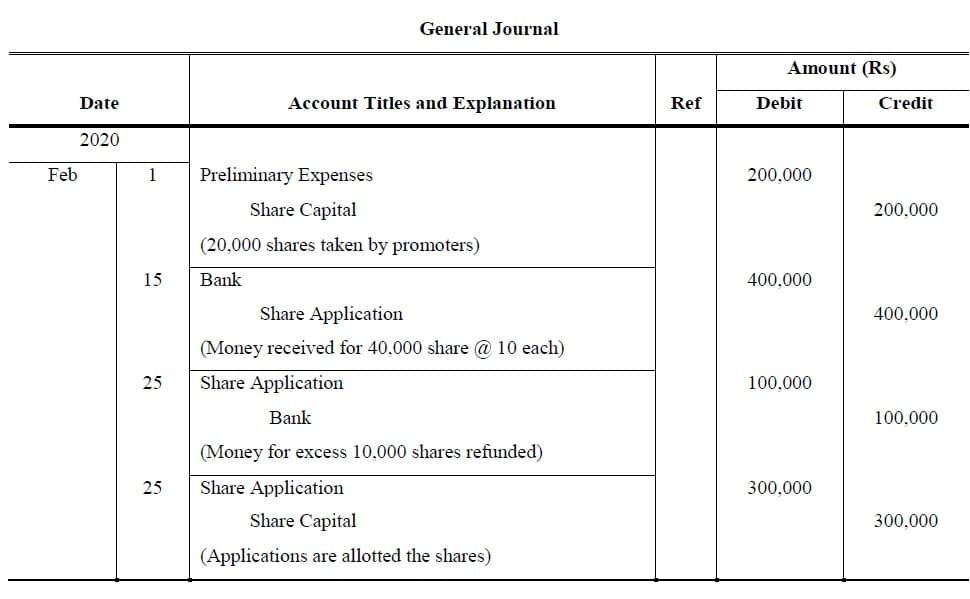

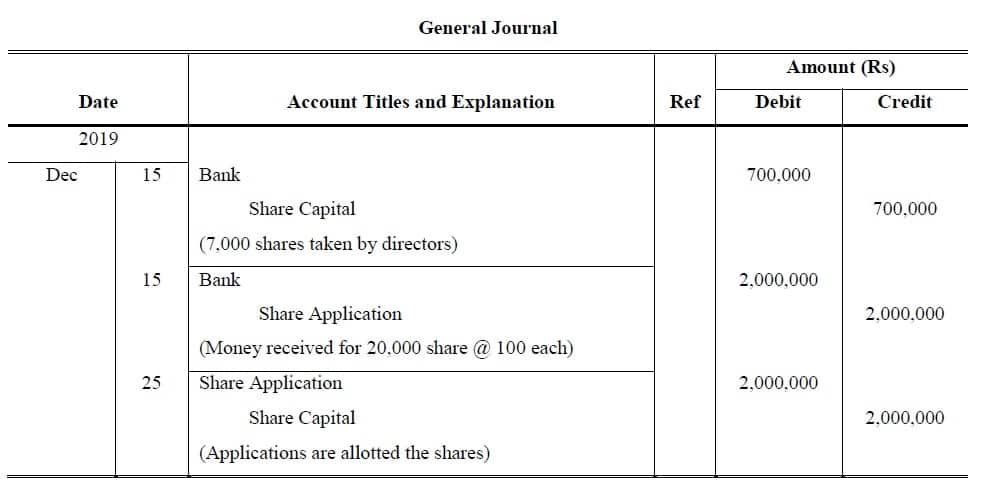

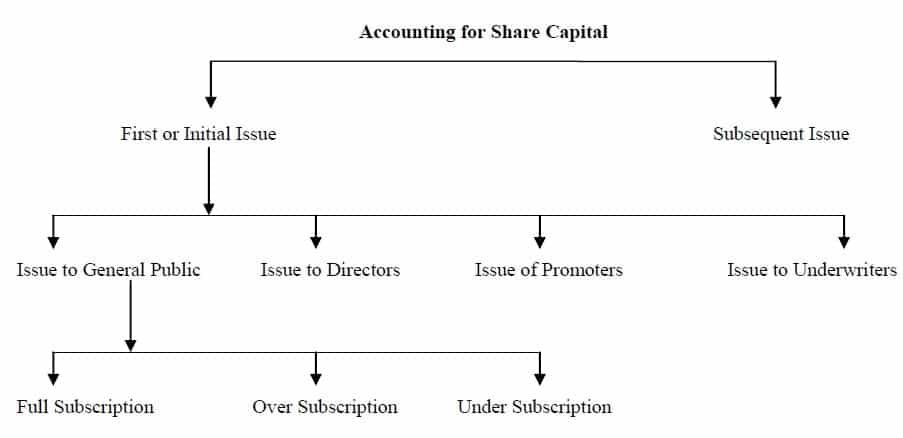

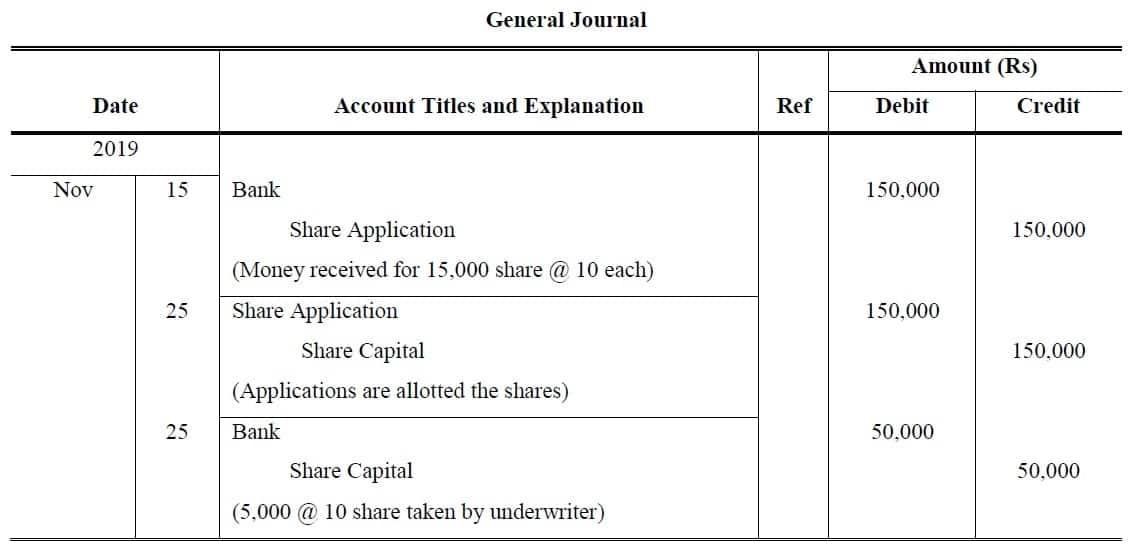

Accounting For Share Capital Comapny Shares Accounting

So for example if you issued 1 million shares with a par value of 2 per share for a total of 3 million.

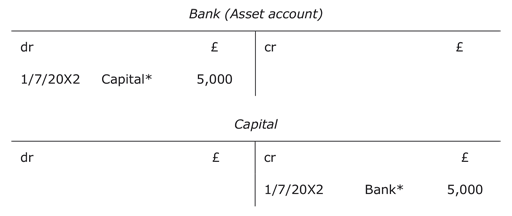

. On 01 April the institutional investors sign the agreement to purchase all 100000 shares at 5 per share. From the businesss point of view its cash has increased by 10000 and its capital. Share capital double entry.

Company D can take the same action as Company C. Share capital shareholders capital equity capital contributed capital or paid-in capital is the amount invested by a companys shareholders for. Capital Contribution Journal Entry Example.

The owner starts up the business in 112013 by putting 10000 of cash in as capital. Unpaid Share Capital - Journal Entries. Dr Share capital 1000k Dr Share premium 490k Cr Profit and loss 490k Cr Cash 1000k.

Example of this Journal Entry On 1st January 2012 The company decided to redeem 10000 7 redeemable preference shares at 13 which had issued at 10 each were fully paid up. Yes to the first assuming it was paid via the Bank. The double entry to â Any issued shares not repurchased are referred to as outstanding shares.

10 on which Rs. Where any paid up share capital is being refunded to share holders without reducing the liability on shares for instance a share of Rs. I am preparing company financial statements and my clients used personal account for.

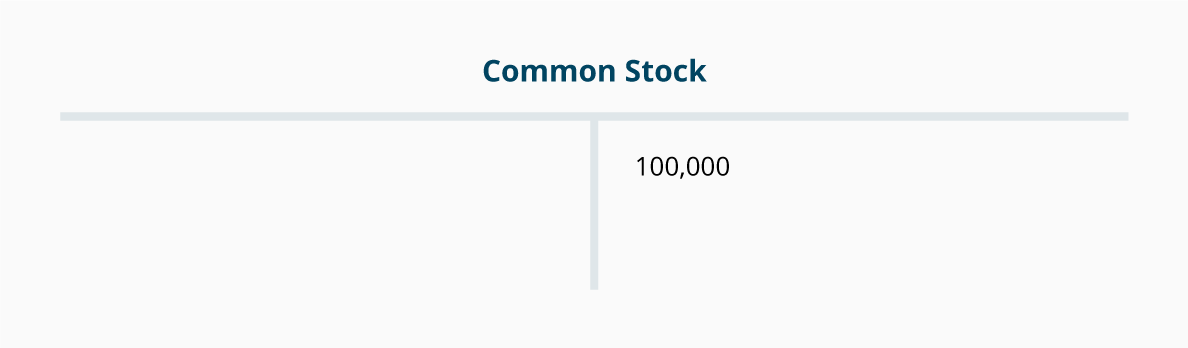

Dr CashBank 10000 x 100 100000. Learn More About American Funds Objective-Based Approach to Investing. A total amount of 3000000 was received.

But would the second double entry not achieve the same thing and render the share effectively paid. I would like some help regards share capital double entry. 2 shares have been issued to 2 shareholders 1 to each.

Due to operation loss company does not have enough money to. Every transaction has two effects. The business issues shareholders with.

As per the terms of the issue of shares 15 per share was to be received in full from the applicants on 30 November 20X3. Called up Share Capital 100000 5 200000 300000. 2 minutes of reading.

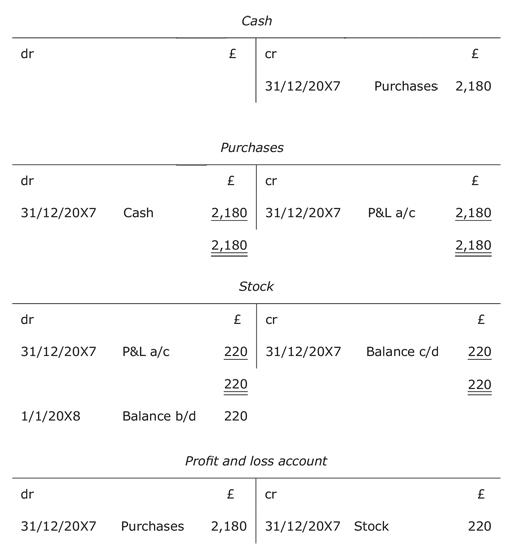

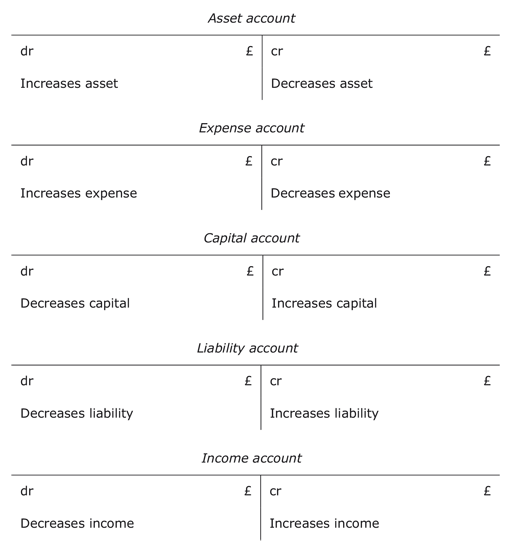

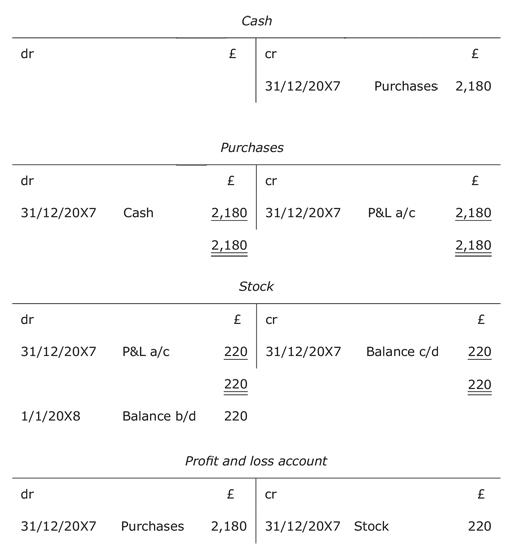

Concept of Double Entry. 6 has been paid up. Tracking share purchases in a double-entry bookkeeping system goes outside my knowledge and I would be glad of advice.

To determine the accounting treatment of preference shares and dividend on such shares first you have to identify if preference shares are redeemable or irredeemable. If share capital is increased in connection with the equity having decreased below the requirements stipulated in the Commercial Code the contribution is usually made for the. Especially if its for a.

10 on which Rs. I have created an account which corresponds to my. 100 the accounting entry for the issue will be as follows.

If the shares are issued at the nominal value ie. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Eg it could use.

Learn More About American Funds Objective-Based Approach to Investing. For example if someone transacts a purchase of a drink from a local store he pays cash to the shopkeeper. So if in the above example the shares had a par value of 050 each the value above the par value is 200 050 150 premium per share and the amount to be shown as.

Dr Share Capital 10000 x 100 100000. Dr Bank 2500000 Dr. A is the only owner of company ABC which start the operation one year ago.

25 million was received in cash and 05 million was still owing. What is Share Capital.

Accounting For Share Capital Comapny Shares Accounting

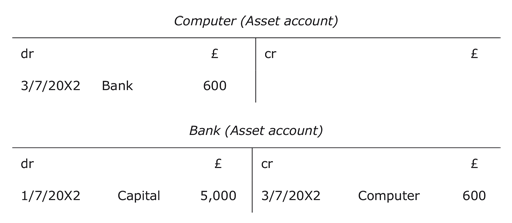

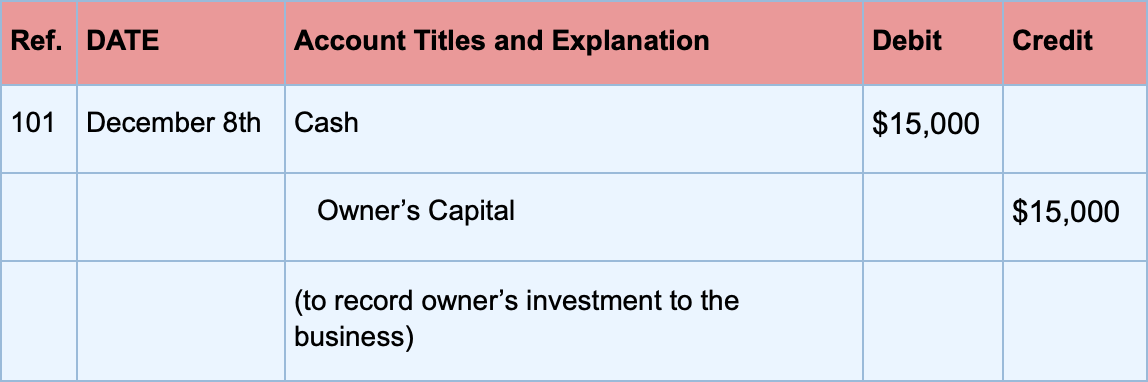

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Capital Introduction Double Entry Bookkeeping

Introduction To Bookkeeping And Accounting Openlearn Open University

Dividends Declared Journal Entry Double Entry Bookkeeping

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Bookkeeping Debits And Credits In The Accounts Accountingcoach

Introduction To Bookkeeping And Accounting Openlearn Open University

Cheat Credit Debit Sheet Credit Credit Bertha Debit Cheat Sheet Accounting Basics Bookkeeping Business Accounting Classes

Accounting For Share Capital Comapny Shares Accounting

What Is Double Entry Bookkeeping Accounting Guide For Small Business

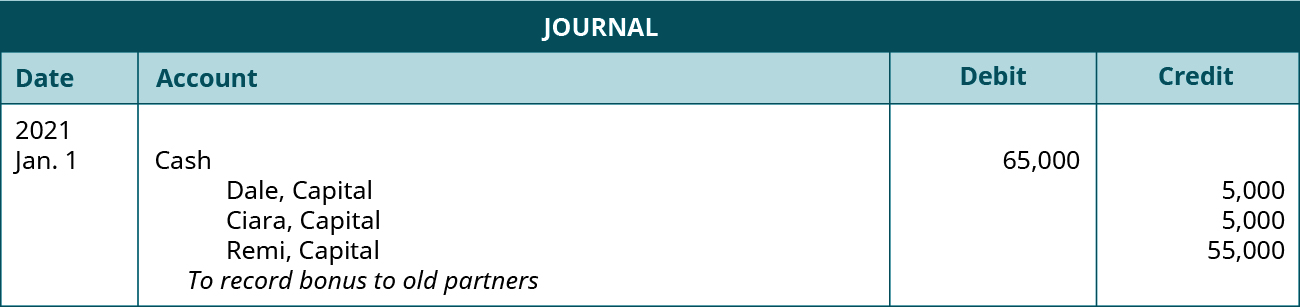

Prepare Journal Entries To Record The Admission And Withdrawal Of A Partner Principles Of Accounting Volume 1 Financial Accounting

Introduction To Bookkeeping And Accounting Openlearn Open University

Accounting For Share Capital Comapny Shares Accounting

Accounting For Share Capital Comapny Shares Accounting

Introduction To Bookkeeping And Accounting Openlearn Open University